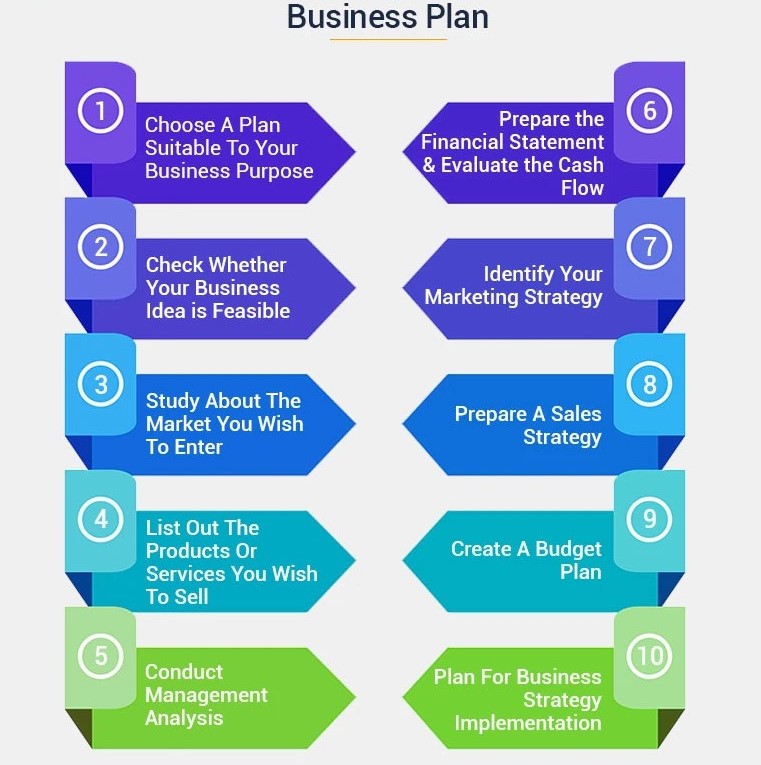

How to Write an Effective Business Plan; Step By Step Guide

An effective business plan will include information about your goals, products, services, and finances.

A business plan outlines your company’s financial goals and how you will achieve them. A detailed, strong plan can provide a roadmap for your business over the next three to five years. You can share this with investors, lenders, or other partners.

This is a step-by-step guide for writing your business plan.

- How to write an executive summary

It is your first page. Consider it your elevator pitch. Include a mission, a description of products and services, and a summary of your plans for financial growth.

It is easier to write the executive summary last, even though it will be the first thing investors read. You can then highlight the information you want to include while writing other sections.

- Description of your company

The following section is the description of your business, which should include information such as:

- The name of your business is registered.

- Your business address.

- The names of the key people within your business. Highlight the unique talents or technical skills of each member of your team.

You should include in your company description the business structure, such as sole proprietorships, partnerships, or corporations. Also, mention the ownership percentage and level of involvement each owner has.

It should also include the current state of your business. The reader will be prepared to read about your goals, which are discussed in the following section.

- Set your business goals.

This is the third part of your business plan. This section outlines what you want to achieve, both short-term and long-term.

This section can describe why you need the money, how it will help you grow your business, and what you plan to do to reach your growth goals. Explaining the business opportunity and how a loan or investment can help your company grow is important.

If your business is launching another product line, you could explain how you believe the loan will assist your company in establishing the new product and how you expect sales to increase over the following three years.

- What are your products and Services?

This section should include details about your products and services.

Include the following in your list:

- Explain how your product or services works.

- Pricing model for product or service

- What type of customers do you typically serve?

- Supply chain and order fulfillment strategy.

- Your sales strategy

- Your distribution strategy.

You can also discuss any trademarks or patents associated with your service or product.

- Market research is essential.

Investors and lenders will want to understand what makes your product different. Explain who your competitors are in your Market Analysis section. Talk about what they are doing well and what you could do better. Explain if you are serving a market that is underserved or different.

- Plan your marketing and sales strategy.

You can discuss how you intend to convince customers to purchase your products or services or how to develop customer loyalty, leading to repeated business.

- Conduct a financial analysis of your business.

You may need to learn more about your financials as a new business. If you have an established business, include:

- A profit and loss statement.

- A balance sheet listing your assets and liabilities.

- A flow chart showing how the cash enters and leaves the company.

You can also include metrics like:

- Net profit margin is the percentage of net income that you retain.

- The current ratio measures your liquidity or ability to pay back debts.

- Accounts Receivable Turnover Ratio: A measurement of how often you collect receivables each year.

It is crucial to include graphs and charts to help those reading your plan understand your financial health.

- Financial projections

This is an essential part of your plan if you seek investors or financing. This section outlines your strategy for generating enough profit to repay the loan or how you’ll earn a good return on investment.

You’ll need to estimate your company’s monthly sales, expenses, and profits over a minimum of three years. The future numbers assume that you have obtained a loan.

Analyze your financial statements carefully before making projections. While your goals can be ambitious, they must also be realistic.

- Add more information to the appendix.

List any additional information that you can’t fit elsewhere. This includes resumes of crucial staff, licenses and permits, equipment leases and permits, patents, and receipts. Also include bank statements, contracts, personal and business credit histories, and bank statements. Consider adding a table of contents at the start of the appendix if it is lengthy.

Resources and tips for business plan development

Your business plan will stand out if you follow these tips:

Avoid being overly optimistic. If you are applying for a loan from a local lender, they will likely know your market well. Giving unreasonable sales estimates may hurt your chances of getting a loan.

Proofread: Grammatical, punctuation, and spelling errors can be glaring and cause lenders and investors to lose interest in your business. They will focus on the mistakes that you made instead of the success of your company. You may need to hire a professional copy editor, proofreader, or business plan writer if you need more strength to write and editing.

Use free resources. SCORE offers a network of business experts and mentors willing to help you create or edit your plan. For more information, you can find a SCORE chapter or search for a business mentor.

You can also use the Small Business Development Centers of the U.S. Small Business Administration, which offer free business consultation and assistance with developing a business plan. Reference Link: https://www.nerdwallet.com/article/small-business/business-plan